A Personal Budget - The Fast Track To Freedom

I know you've heard this before, but there's no getting away from it. In order to manage your money properly you need to have some kind of connection to it, and in personal finance terms that means creating a personal budget.

Yeah OK, so budgets sound boring and SO restricting - especially for the more free spirited ones, like you. But here’s the rub – if you're spending all your energy worrying about money and paying bills - you're wasting your life away. Why not set up a plan to manage it without all the hassle, then you can spend your precious time doing things that really matter to you.

The bottom line is, you have to understand where your money is going. And actually a personal budget can be fun if you set it up correctly...

The Missing Link

Where most people go wrong with the whole budgeting thing, is they don't make it sustainable. By that I mean they don't create a budget that sets them up for success. It's so easy to do - and I'll show you how.

Budgets are one of those things that we know are a good idea. They're a bit like diets - lots of us set them with good intentions, but usually, within weeks, they're relegated to the trash.

Why do we sabotage ourselves this way?

Because we haven't really found a good enough reason to keep going, and we've made them SO restricting it would be like living on lettuce for a month.

So the first thing is, you need to know WHY you're doing this by having a vision of why you even want to do it. And then you need to factor in some ‘fun’ - some little treats to brighten up your week. If you have things to look forward to it's always easier to put up with a little discomfort along the way.

6 Reasons You Need A Budget

ONE To make the most of your money you need to know where it's being spent.

TWO It will help to highlight bad spending habits

THREE It will assist in building good spending habits

FOUR It allows you to pinpoint areas where you can cut back if necessary

FIVE It allows you to PLAN for larger expenses as well as a savings plan

SIX It demonstrates to the Universe that you are to be trusted with money, you're prepared to take care of it... which always leads to more coming your way.

Face Your Financial Situation Head On No Matter How Bad It May Be

OK, so I convinced you... well, to have a think about it at least.

So, first the bit you've been putting off (get that out the way early!).

You need to know where you are now - in gory detail. it's hard, and a bit scary, I know, but I also know from personal experience that when you face the truth about your not-so-good money situation head, on it brings a kind of relief.

Even if the hard reality doesn't look good; at least you are now in action and are DOING something about it instead of just worrying.

A Budget Is Not Only About Spending Less

Creating a budget is so much more than just curbing your expenditure (which is why you should budget even when you're earning bucket loads) – it allows you to see patterns in your spending that you may not have been aware of. This awareness gives you the option to cut out anything unnecessary or change how you spend in some areas.

It also brings up the question – I’m spending all this money on stuff I supposedly want – but is it making me any happier?

The answer to that would have to be ‘no’ if your bank balance is in the red – spending on anything unnecessary is actually adding to your stress and I challenge anyone to say they are ‘happy’ when faced with that kind of worry and fear.

You’ll also find it much easier to put a plan in place to take care of those larger unexpected expenses by creating a savings plan, when you know exactly what money you have and where it’s going.

Setting and working with a budget has it's own rewards apart from the obvious. When you realise how money can disappear alarmingly fast on silly, inconsequential purchases, it makes you start to realise how much you buy that you don't really need to. Often these purchases don't make you any happier, in fact, in many cases, this leads you to realize that you are actually happier without the constant consumer driven spending.

Most importantly of all – and I say this also from personal experience – taking back control of your money leads to a boost in your self esteem, which in turn leads to feeling much better about everything in your life. And when you feel better about your life and yourself, you start to attract better experiences.

As you manage your money, you manage your life

- Dan Millman -

Budgets Are For Everyone

If you think that budgets are only for when you have a perceived shortage of money, think again. Budgets are for everyone – no matter how much money you have.

I made this mistake myself. I have always kept a budget, however, at one point when I was earning a lot of money - guess what? My budget went out the window.

What a mistake that was because I ended up in debt!! I can hear you ask…. HOW? And the answer is, because I had no idea any more where my money was going and I was spending lots of it on stuff I just didn’t need. When my income started to slow down disaster struck … well I’m sure you get the picture.

The lesson here is – even when your finances start to make a turn for the better keep using your budget! You'll change it of course, but keep it in place so you always know where your money is going.

How To Set Up Your Personal Budget

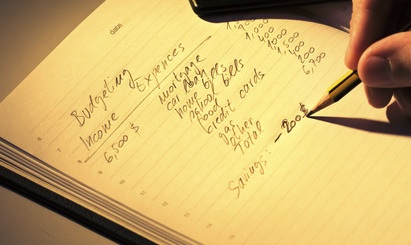

So your next step is to create your budget and then record it using my personal budget worksheet, or your own if you have one. Setting your own personal budget is not difficult, and the benefits so outweigh the hassle of doing it - so let’s get started….

You May Also Be Interested In....

New! Comments

Have your say about what you just read! Leave me a comment in the box below.